Maryland Unemployment

Insurance Information

The Maryland Department of Labor has shared the following information regarding Unemployment Tax Rates for 2021

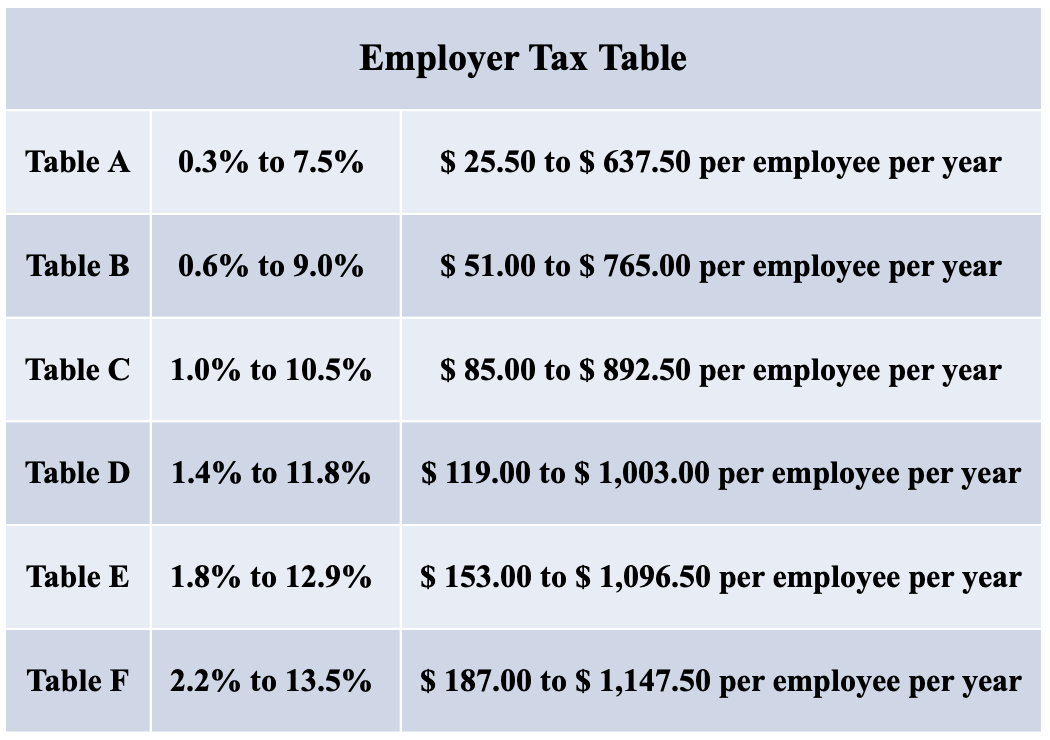

Due to the COVID-19 pandemic, the Division of Unemployment Insurance has paid over $1.5 billion in Unemployment Insurance benefits from the Unemployment Insurance Trust Fund. Because of the balance of the Trust Fund, Tax Table F will apply to employers’ unemployment insurance tax rate for 2021: The range of tax rates for contributory employers in 2021 will be between 2.2% to 13.5%, which is the Table F tax rate schedule. The rate for new employers will be 2.3%. Under Maryland UI law, there is a separate rate for new employers that are in the construction industry and headquartered in another state, which will be 7.0% in 2021. The taxable wage base for 2021 will remain at $8,500.

Payment Plan Options

The Division of Unemployment Insurance has implemented an initiative to assist employers that may find themselves in a position of financial hardship. The Division seeks to assist employers in paying quarterly unemployment insurance taxes for calendar year 2021. Listed below are the Payment Plan options that are available for all four quarterly unemployment insurance returns. Requests for Payment Plans should be made by the quarterly due dates of April 30, 2021, July 31, 2021, November 2, 2021, and February 1, 2022.

All employers are eligible to request a payment plan from the Maryland Division of Unemployment Insurance. Employers can request a payment plan through their BEACON portal and can either request a Standard Payment Plan or a Custom Payment Plan.

Employers may also access this information on the Department’s website at: https://www.dllr.state.md.us/employment/uitaxpaymentplans.shtml

Standard Payment Plan

If the employer has filed all due Maryland quarterly Unemployment Insurance reports, the employers will automatically be approved for the Standard Payment Plan as the Division is in Tax Table F for 2021. The Standard Payment plan requires the employer to make an initial down payment of 25% of the total debt followed by three monthly installments. Employers are required to make the down payment within 30 days of the request. The employer must also provide an explanation as to why they are requesting the Standard Payment Plan.

Custom Payment Plan

Employers may also request a Custom Payment Plan through their BEACON portal. If the employer has filed all due Maryland quarterly Unemployment Insurance reports, the employer automatically qualifies for the Custom Payment Plan as the Division is in Tax Table F for 2021. With a Custom Payment Plan, employers have the option to customize the down payment amount, the number of installments they will make in order to complete the payment plan, and the payment frequency. Employers are required to provide an explanation as to why a Custom Payment Plan is needed instead of the Standard Payment Plan.

To request a Custom Payment Plan, employers are required to provide the following information:

- Down payment amount (in dollars): please provide the dollar amount desired for the down payment

- Number of installments the employer wishes to pay to complete the payment plan

- Payment Frequency: Employers can either pay monthly, weekly, or biweekly (i.e., every other Friday)

Please note that although all employers qualify for a Custom Payment Plan, the Custom Payment Plan is subject to review by the Division. The Division reserves the right to reject the Custom Payment Plan if the Division does not agree to the terms proposed by the employer. If the Division rejects the proposed Custom Payment Plan, the employer may modify the proposed terms and request another Custom Payment Plan through the BEACON portal.